The Ancestor Hunt regularly adds and updates new collection links, as well as searches for and fixes broken links.

(This page's most recent update is February 2026)

Want to improve your newspaper research skills? Become an AcademyPro member of the Newspaper Research Academy at Academy

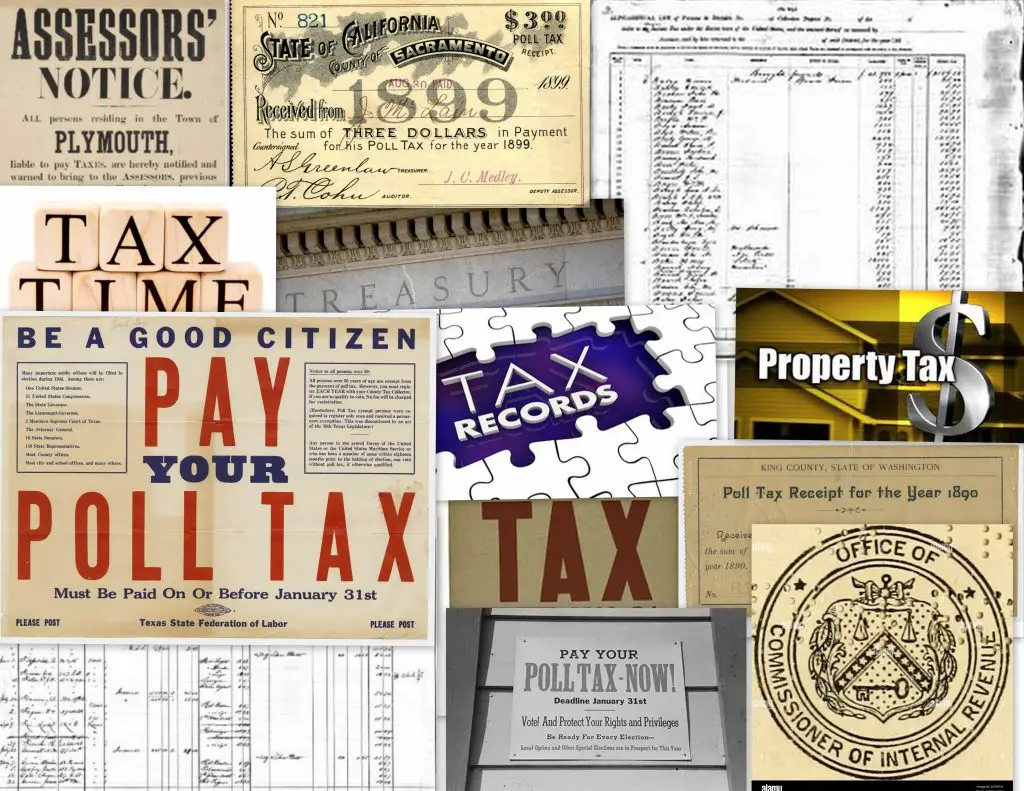

Tax lists are among the most overlooked genealogical records. When census records are missing, incomplete, or lost, tax rolls can provide continuous evidence of residence, property ownership, and even family structure. In some regions, tax records survive decades earlier than surviving census schedules.

Why Tax Lists Matter

Tax records were created annually or periodically to assess and collect revenue. Because taxation was tied to residence and property, these records often establish:

- Exact township or county residence

- Approximate arrival or departure dates

- Economic status

- Land ownership

- Personal property (livestock, tools, slaves in certain eras)

- Voting eligibility in some periods

In areas where early census schedules were destroyed (such as the 1890 federal census), tax rolls may serve as the only annual substitute.

What Tax Lists Typically Include

Content varies by time and place, but many tax rolls include:

- Name of taxpayer

- Acreage owned

- Legal land description

- Value of real property

- Value of personal property

- Number of livestock

- Poll tax (adult males)

- Occupation (occasionally)

- District or township

In some southern states, separate columns recorded enslaved persons by age or category.

Establishing Residency and Timeline

Because tax records were often compiled annually, they help establish:

- When an individual first appears in a locality

- When they disappear (death or relocation)

- Whether multiple men of the same name lived in the same area

- Whether land holdings increased or decreased

A gap of several years may suggest migration, financial hardship, military service, or death.

Identifying Family Relationships

Tax lists sometimes:

- Distinguish between “Sr.” and “Jr.”

- Identify estates (e.g., “Estate of John Smith”)

- Show widow entries

- List sons separately once of taxable age

These patterns can help reconstruct family structure when probate or census data is unavailable.

Geographic Clues

Tax records are often arranged by district or township. Reviewing adjacent names can:

- Identify neighbors

- Reveal migration clusters

- Connect extended family groups

Tax districts frequently align with militia districts, voting precincts, or church parishes.

Research Strategy

When census records are missing:

- Locate county-level tax rolls for the target years.

- Review consecutive years, not just a single entry.

- Compare acreage and valuation changes over time.

- Note nearby surnames.

- Cross-reference with deed and probate records.

Even in years when census records survive, tax rolls can confirm continuous residence between census years.

Limitations

Tax lists generally:

- Omit women (unless widowed or property-owning)

- Exclude minors

- May not list landless laborers

- Sometimes list only the head of household

Despite these limitations, they are powerful substitutes when federal or state census records are missing.

If you’d like this information in a clean, printable, and well-organized reference format, this topic is also included in the Quicksheet Vault. The Vault is designed for researchers who prefer working tools they can save, print, and reuse—whether that means building a personal binder of key resources or keeping reliable references close at hand. You can learn more about the Quicksheet Vault HERE