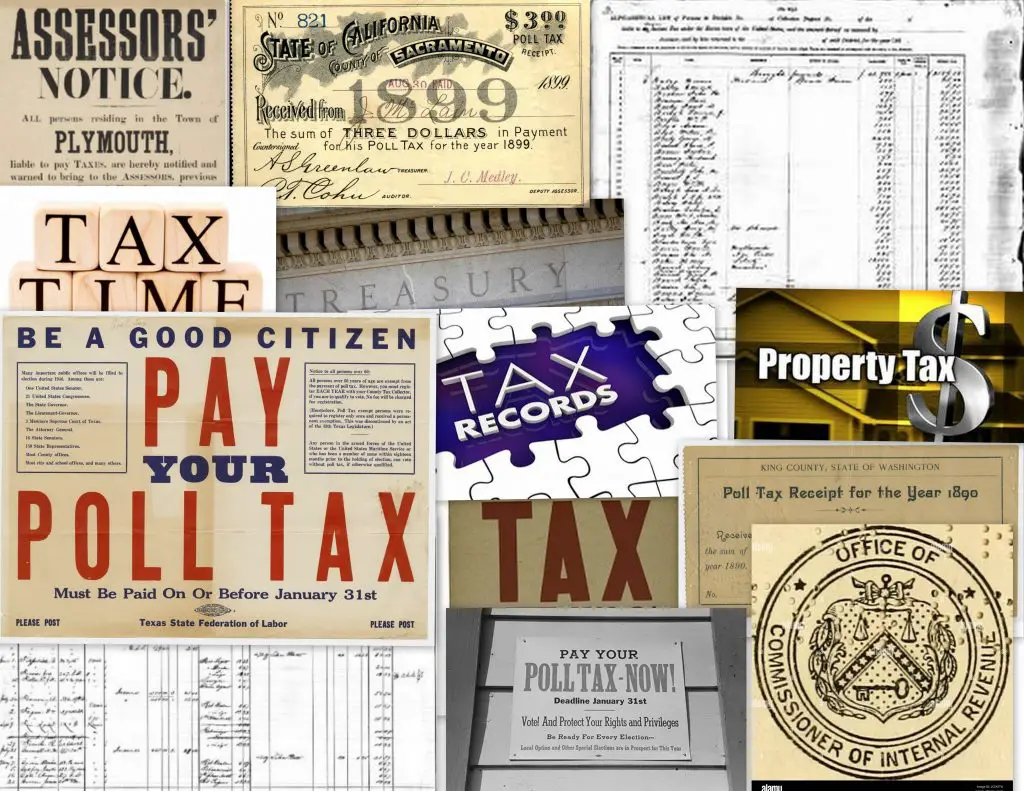

Another type of genealogy record that provides tremendous value is tax records. Like city directories and voting registers, for example, they provide information for us between federal censuses. They also can go back to colonial times.

Types of Taxes

- Income tax

- Federal direct tax

- Poll or head tax

- Real property, e.g., land

- Personal property, e.g., livestock, equipment, carriages, enslaved persons

- Other, such as special levies for roads, schools, etc.

Types of Information in Tax Records

- Date

- Residence address; property, license, or goods; value; tax amount; possibly profession, occupation, or trade

- Name of the taxpayer, usually white adult males

- Town/township/city, county, and state of residence

- Owner and/or renter of the property

- Number of white adult males in the home

- Type and value of property taxed

- Livestock owned

- Personal property owned

- Amount of tax owed

- Profession, occupation, or trade

- Number of school-aged children

- Number of enslaved persons

Derivative information, such as birth date, death date, and date of marriage can often be estimated or determined from the presence or absence of a person in a tax list.

Good primers regarding the genealogical value of tax records and more details can be found in these articles:

- The Genealogical Benefits of Tax Records

- Using Poll Tax Records for Genealogy

- Genealogy 101: Tax Records

- Back to the Basics with Tax Records: Part 1

- Back to the Basics with Tax Records: Part 2

- Back to the Basics with Tax Records: Part 3

- United States Taxation

- The Value of Using US Tax Records in Genealogy Research